Using the W-2 Preview Report

How to generate a report previewing your company's W-2 information and how to make changes.

OVERVIEW

The W-2 Preview Report contains a draft copy of your company’s W-2 in IRS format. Reports are refreshed nightly and will contain a stamp noting the date of their generation. This report can assist you in avoiding amendments and W-2cs to help you prepare for a successful year end. Visit Namely's Add-On Pricing Guide more information on the cost of W-2cs and Amendments.

We recommend running this report quarterly. By conducting an audit before quarter end, you can avoid amendment fees and tax penalties. In December, prepare for year end by reviewing this report after every payroll so that changes have enough time to be processed and included on the original W-2s.

Use cases:

-

If you have an employee who has undergone changes (moved states, name change, etc.) that could impact their W-2, reviewing the employee’s W-2 preview enables you to verify the actual impact in real time instead of waiting for a year end reconciliation.

-

If you have an employee who over or under-withheld last year and wants to be more prepared this year, you can securely share their W-2 preview and make any necessary adjustments before year end.

-

If you had an outstanding amount of amendments last year and would like to verify the W-2 data in order to avoid the hassle and fees of W-2cs and amendments, you can use this report to conduct routine audits.

ACCESS

Only administrators with the ability to use Namely Payroll can access year-round W-2 and 1099 preview reports.

To download the report in Namely Payroll:

-

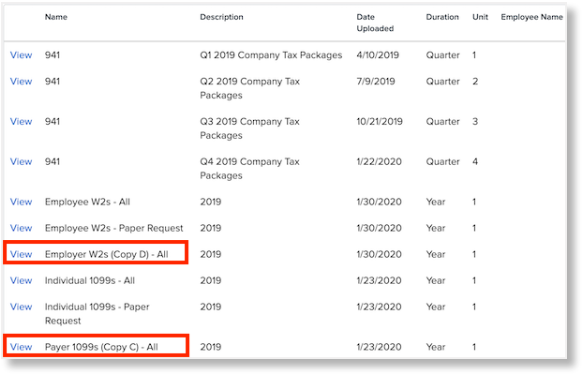

Go to Reports > Quarterly and Year End.

-

Select 2023 for the Year.

-

Click either the Employer W2s (Copy D) - All or Payer 1099s (Copy C) - All.

USING THE REPORT

This report will help identify issues on employee W-2s that could lead to W-2cs. Here are some potential discrepancies to review:

-

State does not match

-

Example: The employee's office location is in New York but the employee has no state withholding or is withholding in the incorrect state.

-

-

Mid Year tax checkup

-

Check that withholding is correct and make adjustments based on seeing accurately where you’re at (on the individual employee level).

-

-

Review the clients with special markings in box 12 and 14

-

Verify that mappings are appearing as expected on the W-2 preview ahead of time to avoid W-2cs

-

-

Ensure the taxable wages are correct

-

If you’re using additional pay codes (other than salary and hourly), double check if the employees are taxed correctly in boxes 1, 3, and 5

-

-

Securely send this report to employees to verify their SSN, name, and address.

Company

-

Review the Address, Name, FEIN

Refer toEmployee Guide to the Form W-2 for further details.

Tip:

The W-2s and 1099s contained in these reports should not be used for filing and will contain watermarks noting this. Additionally, they will not display in a “quad” format.

CASE SUBMISSION DETAILS

If you've identified an issue with your taxes, you'll want to submit a case in ClientSpace to ensure proper filing.

• Category: Payroll N

• Case Type: W-2

• Fill out the Subject and Description fields.

• Attach any documents (if applicable).